TL;DR

OfferGridAI uses AI to extract key terms from uploaded purchase offers (PDFs) and produces a side-by-side comparison with risk scores. The service highlights price, financing, contingencies, timelines and net proceeds, and offers a free first property analysis with no credit card required.

What happened

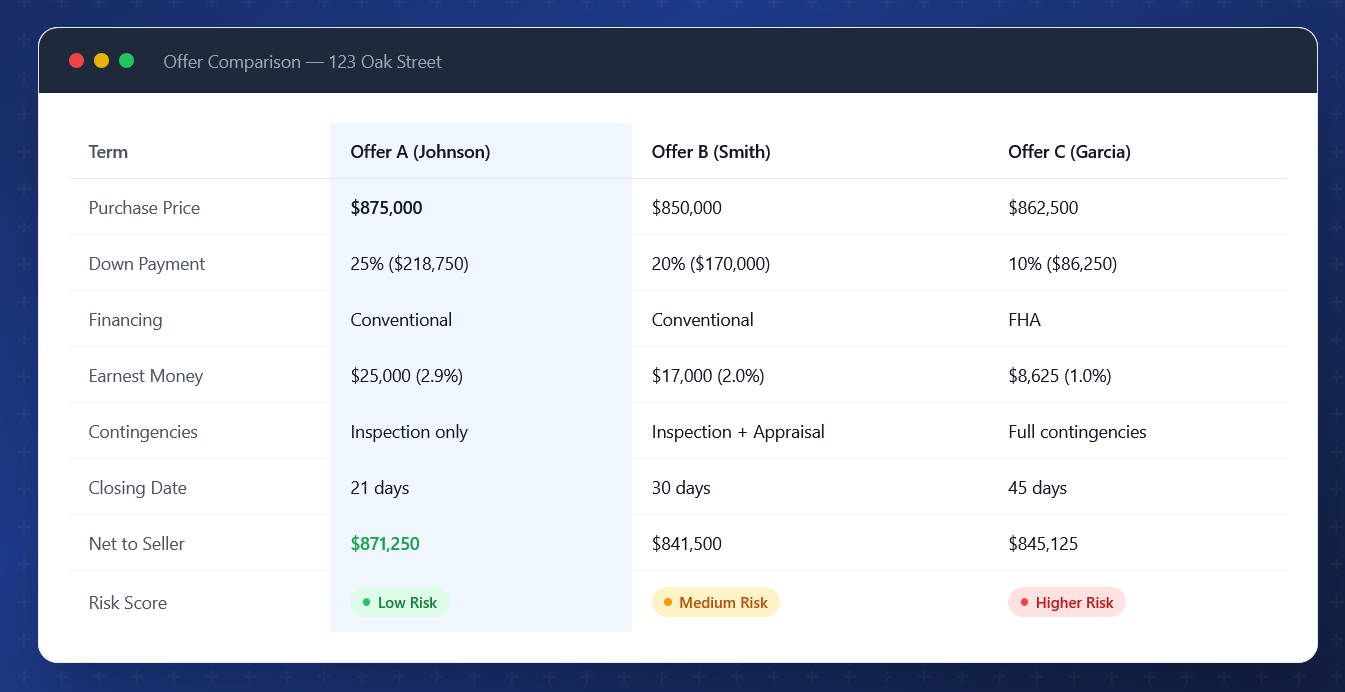

OfferGridAI launched a tool aimed at real estate professionals to speed up review of multiple purchase offers. Users upload purchase-offer documents and the system automatically extracts core terms—purchase price, financing type and pre-approval status, down payment and earnest money, contingencies and their timeframes, closing and possession dates, and other special terms such as seller concessions and included items. The platform then assembles a comparison grid showing those fields side-by-side and assigns an AI-powered risk score for each offer based on financing, contingencies, timeline and buyer qualification. An example comparison for a sample property lists three offers with differing prices, down payments, earnest money amounts, closing dates and net-to-seller calculations. OfferGridAI advertises a free first property analysis, no credit card needed, and results available in under two minutes.

Why it matters

- Condenses lengthy offer documents into a standardized comparison format, saving time for listing agents and sellers.

- Risk scores provide a quick, comparable indicator of offer strength beyond headline price alone.

- Extraction of contingencies, earnest money and closing dates helps clarify non-price tradeoffs that affect net proceeds and closing certainty.

- A fast, repeatable workflow can help teams present options to sellers more quickly and consistently.

Key facts

- The tool extracts purchase price, financing type, down payment and earnest money, contingencies, closing timeline and special terms from uploaded offers.

- AI assigns risk scores labeled Low Risk, Medium Risk and Higher Risk based on financing type, contingencies, timeline and buyer qualification.

- Sample comparison shown for a property with three offers: $875,000; $850,000; and $862,500 purchase prices.

- Sample down payment figures in the example are 25% ($218,750), 20% ($170,000) and 10% ($86,250).

- Earnest money examples shown: $25,000 (2.9%), $17,000 (2.0%) and $8,625 (1.0%).

- Sample closing timelines presented in the example are 21 days, 30 days and 45 days.

- Net-to-seller example amounts in the table are $871,250; $841,500; and $845,125 respectively.

- The site advertises a free first property analysis, does not require a credit card, and promises results in under two minutes.

- OfferGridAI is positioned for real estate professionals to compare multiple offers in minutes instead of hours.

What to watch next

- Pricing and subscription terms after the free first property analysis are not confirmed in the source

- Data security, document handling and compliance practices for uploaded offers are not confirmed in the source

- Integrations with MLS, CRMs or transaction-management platforms are not confirmed in the source

Quick glossary

- Contingency: A condition in a purchase contract that must be met for the sale to proceed, such as inspection or financing contingencies.

- Earnest money: A deposit made by a buyer to demonstrate commitment to a transaction, often held in escrow until closing or contract termination.

- Down payment: The portion of the purchase price paid upfront by the buyer, typically expressed as a dollar amount and a percentage of the price.

- Pre-approval: A lender’s preliminary commitment indicating that a buyer is conditionally approved for a loan up to a specified amount.

- Risk score: A numerical or categorical assessment intended to summarize the relative likelihood an offer will close successfully, based on factors such as financing and contingencies.

Reader FAQ

What does OfferGridAI do?

It extracts key terms from uploaded purchase-offer documents and presents a side-by-side comparison with AI-derived risk scores.

Is there a free option?

Yes — the site advertises a first property analysis free and no credit card required.

How long do results take?

The site states results are provided in under two minutes.

What file formats are supported?

The source references comparisons from PDFs and instructs users to upload purchase offers.

How accurate are the AI risk scores?

Not confirmed in the source

Every Detail, Automatically Extracted Our AI is trained to find and extract the terms that matter most to your sellers Purchase Price Total offer amount plus any price escalation clauses…

Sources

- Show HN: OfferGridAI – side-by-side comparison of real estate offers from PDFs

- Offer Generator AI – Automated Real Estate Offers

- Offerd | AI-Powered CRE Brokerage Platform

- AI Agents for Deal Comparison and Negotiation Analysis in …

Related posts

- OfferGridAI: AI extracts and compares real estate offers from PDFs

- Fender Debuts Mix Wireless Headphones with Replaceable Long-Life Battery

- Fender Audio debuts ELIE Bluetooth speakers that accept four simultaneous sources