TL;DR

Nvidia has aggressively expanded into venture investing, participating in more than 100 AI startup financings over the past two years and markedly increasing deal activity in 2025. The company has taken part in numerous billion- and multi-hundred-million-dollar rounds, sometimes tied to strategic commitments for compute purchases.

What happened

Over the last two years Nvidia has broadened its role from GPU supplier to active corporate investor in artificial intelligence startups. PitchBook data cited by TechCrunch shows the company participated in 67 venture deals in 2025, up from 54 in all of 2024; these counts exclude deals by its formal corporate fund, NVentures, which itself ramped from one deal in 2022 to 30 in 2025. Nvidia has joined financings across a wide swath of AI firms, including multiple billion-dollar rounds (OpenAI, Anthropic, Cursor, xAI, Mistral, Reflection AI, Thinking Machines, Inflection, Crusoe, Nscale, Wayve, Figure, and Scale) as well as many rounds in the several-hundred-million-dollar range. Several investments are framed as strategic relationships that can include commitments to buy Nvidia hardware or deploy large-scale compute, and Nvidia has described its corporate investing objective as expanding the AI ecosystem by backing potential "game changers and market makers."

Why it matters

- Nvidia’s investments extend its influence beyond chip sales into the AI software and infrastructure layer, shaping which startups gain capital and access to hardware.

- Strategic financings can lock in demand for Nvidia systems, tying capital flows to future purchases of its GPUs and servers.

- Rapid deal activity increases Nvidia’s financial exposure to startup outcomes and makes its corporate role more entwined with its customers and competitors.

- Large pledged commitments (for example to OpenAI and Anthropic) could alter industry compute dynamics if completed, but some promised investments are not guaranteed.

Key facts

- Nvidia’s market capitalization reached about $4.6 trillion as AI-driven revenue and cash reserves expanded.

- PitchBook counted roughly 67 venture deals involving Nvidia in 2025, exceeding the 54 deals recorded in all of 2024; NVentures separately engaged in about 30 deals in 2025.

- Nvidia took part in a $6.6 billion OpenAI round in October 2024, reportedly contributing $100 million, and later announced an intent to invest up to $100 billion over time—though its filings said such investments aren’t assured.

- The company committed to large strategic investments in other labs: up to $10 billion in Anthropic (November 2025) and participation in xAI’s $6 billion round plus a reported up-to-$2 billion equity investment.

- Nvidia joined multiple billion-dollar financings for startups including Cursor ($2.3B Series D), Mistral (€1.7B Series C), Reflection AI ($2B), Thinking Machines Lab ($2B seed), and Figure AI (Series C over $1B).

- It also backed infrastructure and data-center plays tied to OpenAI’s Stargate project, including Crusoe and Nscale.

- Nvidia has been an investor in enterprise model and tooling companies such as Scale AI, Cohere, Perplexity and Lambda through rounds ranging from several hundred million to a billion dollars.

- Some investments are structured to support hardware purchases by the recipients—for example Anthropic’s commitments to buy specific Nvidia systems and xAI’s reported plan to acquire Nvidia gear.

What to watch next

- Whether Nvidia completes major pledged investments (for example the announced up-to-$100 billion in OpenAI and the up-to-$10 billion commitment to Anthropic) — filings have said completion is not assured.

- The ongoing deal pace from NVentures and Nvidia’s corporate investing arm, and whether 2025’s elevated activity continues into future years.

- Potential regulatory or antitrust scrutiny tied to Nvidia’s dual role as a dominant hardware supplier and an investor in many AI startups — not confirmed in the source.

Quick glossary

- GPU: Graphics processing unit — a class of processor widely used for the high‑throughput computations required to train and run AI models.

- Venture capital (VC): Equity financing provided to early‑stage, high‑growth companies in exchange for ownership stakes.

- Series round (e.g., Series B, Series C, Series D): Stages of startup financing typically representing successive funding events as a company grows and seeks larger investments.

- SAFE: Simple Agreement for Future Equity — an instrument that provides investors rights to future equity without determining a specific price at the time of investment.

- Large language model (LLM): A type of AI model trained on large text corpora to perform tasks like text generation, translation, and question answering.

Reader FAQ

Has Nvidia invested in OpenAI?

Yes — Nvidia participated in OpenAI’s October 2024 $6.6 billion round with a reported $100 million contribution and later announced an intention to invest up to $100 billion over time; its filings say such future investments are not guaranteed.

How many AI startup deals has Nvidia done recently?

PitchBook data cited in the source reports Nvidia participated in about 67 venture deals in 2025 and over 100 startup investments over the past two years.

Does Nvidia use investments to secure hardware sales?

Some financings are described as strategic and include commitments by startups to buy Nvidia systems, as noted for Anthropic and xAI in the source.

Is Nvidia’s NVentures separate from its corporate investments?

Yes — NVentures is Nvidia’s formal corporate VC fund; PitchBook reports NVentures engaged in about 30 deals in 2025 versus one in 2022.

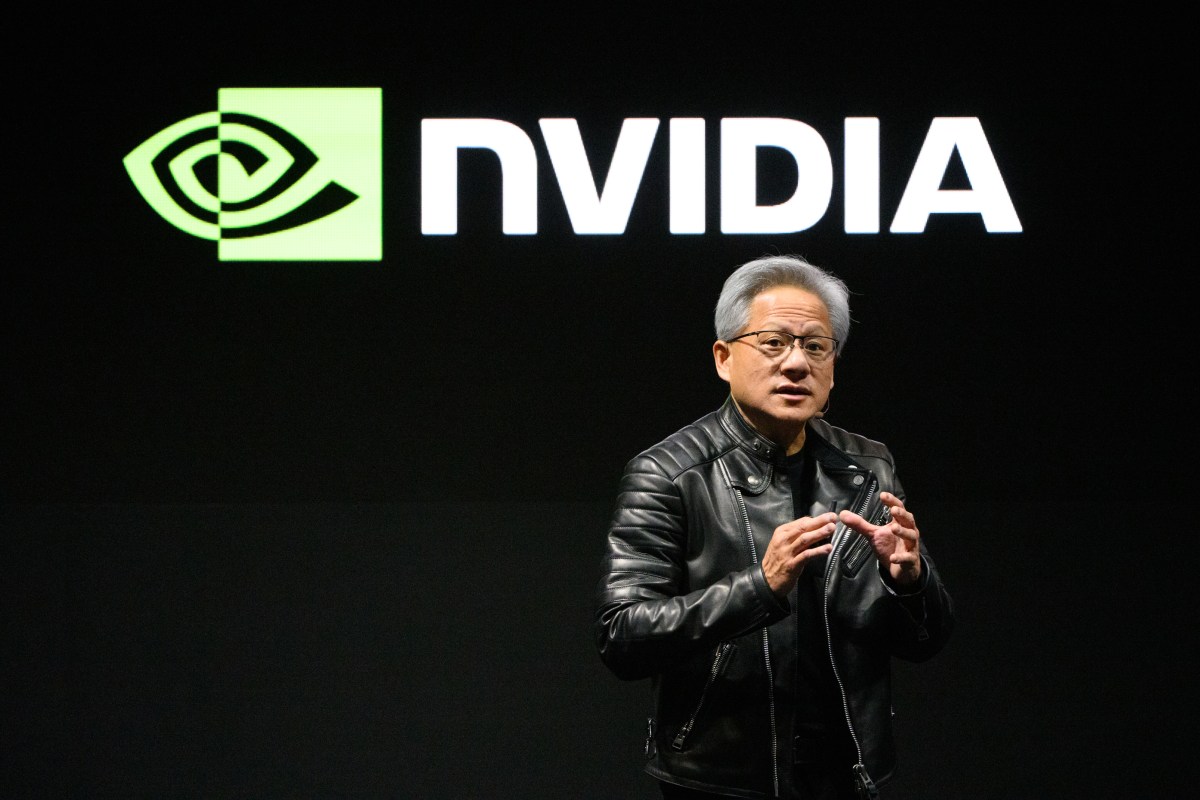

No company has capitalized on the AI revolution more dramatically than Nvidia. Its revenue, profitability, and cash reserves have skyrocketed since the introduction of ChatGPT over three years ago —…

Sources

- Nvidia’s AI empire: A look at its top startup investments

- Nvidia's AI empire: A look at its top startup investments

- NVIDIA's AI Empire: Strategic Startup Investments in 2025

- Nvidia's AI Empire: A Look at Its Top Startup Investments

Related posts

- What Apple May Release in January: Macs, iOS 26.3, and Early 2026 Plans

- GE Profile Smart Fridge Gets Patented Scan-to-List Barcode Scanner

- Pebble Round 2 revives the Time Round with larger screen, long battery