TL;DR

The Wall Street Journal reports Apple is expected to appoint JPMorgan Chase to succeed Goldman Sachs as the financial backer of the Apple Card. JPMorgan would acquire existing card balances at a significant discount and will also back new Apple-branded savings accounts, while some current savings customers may be allowed to remain with Goldman.

What happened

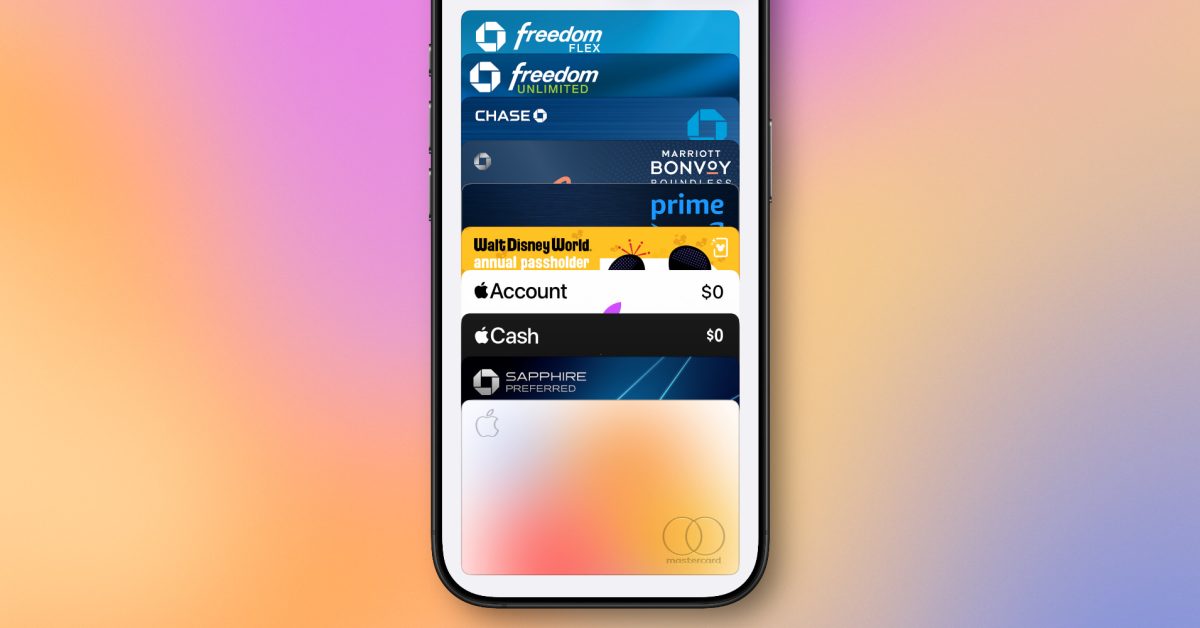

According to a Wall Street Journal report cited by 9to5Mac, Apple is poised to move the Apple Card relationship from Goldman Sachs to JPMorgan Chase. Goldman has been reportedly looking to exit the partnership for more than two years after the consumer credit card operation produced multibillion-dollar losses for the bank. The WSJ sources say JPMorgan will take on roughly $20 billion in outstanding Apple Card balances from Goldman at a discount exceeding $1 billion. The report notes that most co-branded credit portfolios typically sell at a premium, making this deal unusual. In addition to inheriting card balances, JPMorgan is said to be preparing to offer a new Apple-branded savings account; existing Apple savings account holders at Goldman would have the option to remain with Goldman or move to JPMorgan. The paperwork and official announcement are expected soon, per the report.

Why it matters

- A change of issuing bank affects the financial infrastructure behind a widely used Apple service and may influence product terms or operations.

- Transferring a large portfolio of balances at a steep discount highlights the financial strain Apple Card posed for Goldman Sachs.

- JPMorgan’s involvement and a planned Apple-branded savings product suggest continued expansion of Apple’s consumer financial services.

- Cardholders and savings-account customers could face choices about whether to remain with Goldman or move to JPMorgan, with potential customer‑service and account-management implications.

Key facts

- The Wall Street Journal is cited as the source reporting JPMorgan Chase will replace Goldman Sachs as Apple Card’s backer.

- Goldman Sachs has reportedly sought an exit from the Apple Card partnership for more than two years.

- The consumer credit card business tied to Apple Card was reportedly a multibillion-dollar loss for Goldman Sachs.

- JPMorgan is expected to acquire about $20 billion of outstanding Apple Card balances from Goldman at a discount of more than $1 billion, according to people familiar with the matter.

- Most co-branded card portfolios typically sell at a premium (up to about 8% or more for the strongest programs); discounts are described as rare.

- JPMorgan is reportedly planning to offer a new Apple-branded savings account.

- Consumers with existing Apple savings accounts at Goldman may be able to either remain with Goldman or open accounts with JPMorgan.

- Apple Card was announced in 2019 and is available only in the United States.

- Apple Card features include 3% back on Apple and select merchant purchases via Apple Pay and 2% back on other purchases made with Apple Pay.

What to watch next

- Timing of an official announcement — the report says the deal is expected to be announced soon.

- Whether existing Apple Card account terms, interest rates or rewards will change after the transfer — not confirmed in the source.

- How many Apple savings account holders choose to remain with Goldman versus move to JPMorgan — not confirmed in the source.

Quick glossary

- Co-branded credit card: A credit card offered through a partnership between a retailer or brand and a bank, combining merchant benefits with the bank’s financial services.

- Issuing bank / backer: The financial institution that provides the credit, holds card balances, manages underwriting and regulatory responsibilities for a credit card product.

- Portfolio transfer (balance sale): The sale or transfer of an existing pool of loans or credit card balances from one financial institution to another, sometimes at a premium or discount.

- Apple Card: Apple’s branded credit card integrated with the iPhone Wallet app and Apple Pay, launched by Apple in 2019.

- Apple Pay: Apple’s mobile payments and digital wallet service that enables contactless payments using compatible Apple devices.

Reader FAQ

Who will replace Goldman Sachs as the Apple Card partner?

The Wall Street Journal reports JPMorgan Chase is expected to take over as the Apple Card backer.

Will existing Apple Card balances move to JPMorgan?

According to the report, JPMorgan will take on existing balances; roughly $20 billion of outstanding balances is cited, with Goldman selling at a discount of more than $1 billion.

Will Apple savings accounts move to JPMorgan automatically?

The report says consumers with Apple savings accounts at Goldman would be able to decide whether to remain with Goldman or open accounts with JPMorgan.

Why is Goldman Sachs exiting the Apple Card deal?

The report states Goldman’s consumer credit card business tied to Apple Card generated multibillion‑dollar losses; further details are not provided in the source.

iOS 26 gave Apple Music three of my favorite new features in years Ryan Christoffel Jan 6 2026 APPLE NEWS APPLE CARD Apple reportedly finds Apple Card partner to replace…

Sources

- Apple reportedly finds Apple Card partner to replace Goldman Sachs

- JPMorgan Chase reaches deal to take over Apple Card

- Apple Credit Card To Be Taken Over By JPMorgan Chase

- Apple announces big change to its credit card

Related posts

- OpenAI launches ChatGPT Health, a dedicated space for health and wellness

- Claude Code 2.1.0 version-parsing bug prevents CLI from starting on macOS

- Google to pay Play Store users from $630M settlement, payouts imminent