TL;DR

Apple announced Chase will take over as the issuer of Apple Card, with the switch expected in about 24 months. Apple says card use, rewards, and account management will continue normally and that users do not need to reapply or take action now.

What happened

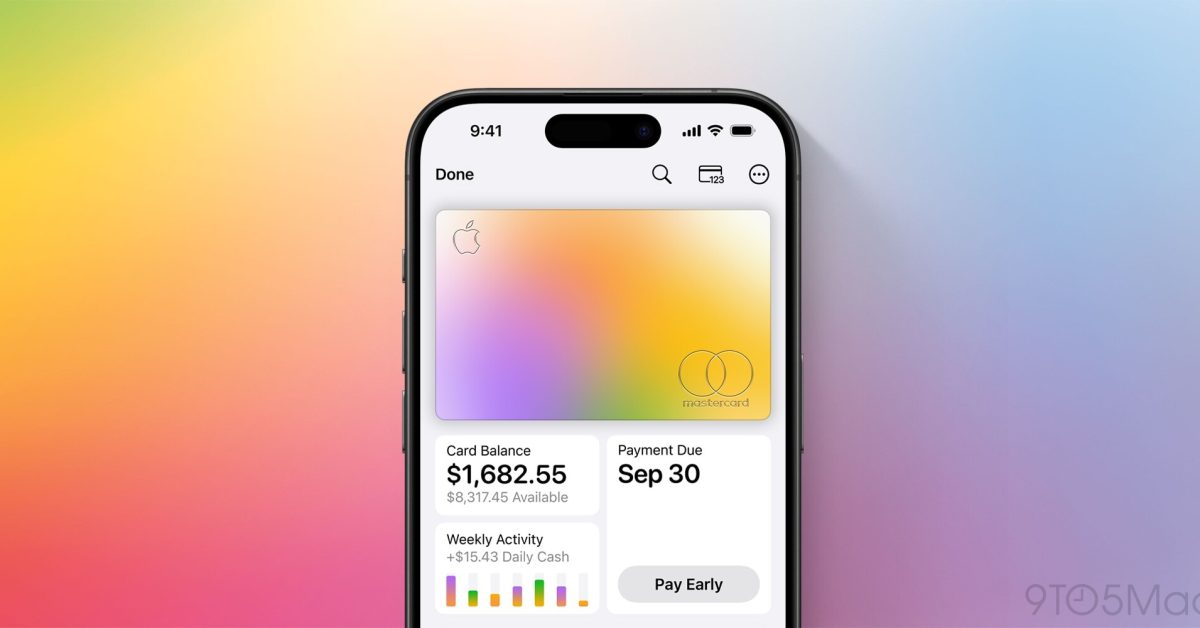

Apple confirmed in a press release that JPMorgan Chase will become the new issuer of the Apple Card, succeeding Goldman Sachs, and that the transition is planned to occur in approximately 24 months. The announcement followed a Wall Street Journal report and is accompanied by an Apple web page of frequently asked questions. Apple told customers they can continue to use their current physical and digital Apple Card as usual, manage accounts in the Wallet app, and keep access to features such as Savings and Apple Card Monthly Installments. Mastercard will remain the payment network, and Apple said customers will continue to earn up to 3% unlimited Daily Cash on purchases. Apple also stated there is nothing users need to do now, and that additional information about the migration and any changes will be communicated directly to Apple Card customers as the transition date nears.

Why it matters

- The bank that holds and services Apple Card accounts will shift from Goldman Sachs to Chase, affecting the backend account issuer.

- Apple is assuring continuity for core user experiences — payments, Wallet management, Daily Cash and fee structure — during the handoff.

- Customers do not need to reapply or take action now, which reduces short-term disruption risk for cardholders.

- Keeping Mastercard as the payment network preserves compatibility with existing merchant acceptance and card processing.

Key facts

- New issuer: JPMorgan Chase will replace Goldman Sachs for Apple Card accounts.

- Timeline: Apple says the transition will occur in approximately 24 months.

- No reapplication: Existing Apple Card users do not need to reapply to keep their accounts.

- Payment network: Mastercard will continue to serve as the card’s payment network.

- Account management: Cardholders can continue to manage their Apple Card in the Wallet app.

- Physical card: Current tactile Apple Card physical cards can continue to be used as normal.

- Rewards: Cardholders will still earn up to 3% unlimited Daily Cash on purchases.

- Services: Access to Savings and Apple Card Monthly Installments (ACMI) will continue; further details will be provided later.

- Fees: Apple states Apple Card will continue to have no annual, late, or foreign transaction fees.

What to watch next

- How Apple and Chase will transfer account servicing and what, if any, changes customers may see during the migration (not confirmed in the source).

- Whether any changes will be made to physical card design, issued account numbers, or card replacement policies (not confirmed in the source).

- Additional specifics about how Savings accounts will be handled under Chase and any timeline updates Apple will provide as the transition date approaches (not confirmed in the source).

Quick glossary

- Issuer: The bank or financial institution that issues a credit card account, handles credit decisions, billing and account servicing.

- Mastercard: A global payments network that processes card transactions between merchants, banks and cardholders.

- Daily Cash: Apple’s cash-back rewards program that returns a percentage of purchases to users as cash available on their card.

- Wallet app: Apple’s application on iPhone and Apple Watch for managing payment cards, passes and related financial services.

- Apple Card Monthly Installments (ACMI): A financing option that lets customers pay for Apple products over time through their Apple Card account.

Reader FAQ

Do Apple Card users need to reapply for the card?

No — Apple says existing Apple Card users do not need to reapply.

Will the payment network change?

No — Mastercard will continue to be the card’s payment network.

Will I keep my Daily Cash rewards and account access?

Yes — Apple says users will continue to earn up to 3% unlimited Daily Cash and can manage accounts in the Wallet app.

Is there anything cardholders must do now to prepare for the switch?

Apple says there is nothing users need to do at this time; additional details will be shared as the transition date approaches.

iOS 26 gave Apple Music three of my favorite new features in years Ryan Christoffel Jan 6 2026 Apple confirms Chase takeover for Apple Card and reveals new details Chance…

Sources

- Apple confirms Chase takeover for Apple Card and reveals new details

- Gurman: Chase Bank is 'Ideal Partner' to Take Over Apple Card Deal

- Chase to become new issuer of Apple Card

- JPMorgan Chase, Apple Card: Nearing deal to replace …

Related posts

- Character.AI and Google Reach Settlements in Teen Suicide, Self-Harm Lawsuits

- Best Buy Slashes $50 Off Apple AirPods Pro 3 — Now Around $200

- The iOS 26 settings I changed immediately on my iPhone — quick tweaks