TL;DR

Type One Energy secured an $87 million convertible note, bringing its venture funding to over $160 million, and is in the process of raising a $250 million Series B at a $900 million pre-money valuation. The startup is developing a stellarator-based magnetic confinement fusion design and has a commercial deal with the Tennessee Valley Authority for a 350 MW plant.

What happened

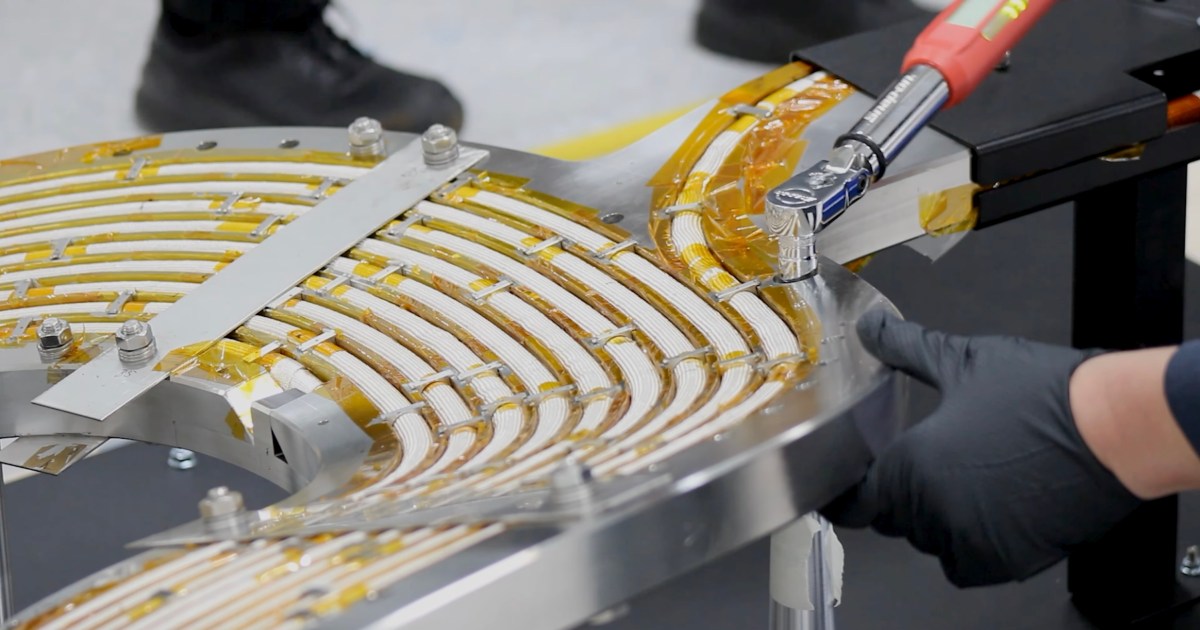

Type One Energy closed an $87 million convertible note that increases the startup’s venture funding to more than $160 million. The company says it is simultaneously pursuing a $250 million Series B round at a $900 million pre-money valuation. Type One’s approach uses magnetic confinement in a stellarator configuration — a twisted torus of magnets intended to contain and control fusion plasma — and the company says it is refining that technology with the new capital. Type One has a commercial agreement with the Tennessee Valley Authority to site its first planned plant, dubbed Infinity Two, at the former Bull Run coal plant; the project is projected to produce about 350 megawatts and could be operational in the mid-2030s, according to the company. Rather than building and operating reactors itself, Type One intends to sell core technology to utilities and other plant operators.

Why it matters

- The new financing extends investor support for fusion startups and advances Type One’s pathway toward a commercial pilot.

- A working stellarator-based plant would represent a different magnetic-confinement route than more commonly publicized tokamak efforts.

- Projected growth in electricity demand — notably from data centers — increases incentives for new low-carbon, high-capacity generation options.

- Type One’s planned commercial arrangement with a utility could serve as an early model for private–public deployment of fusion technology.

Key facts

- $87 million: the amount of the recent convertible note raised by Type One Energy.

- More than $160 million: total venture investment in the company after the new note.

- $250 million: the target size of Type One’s ongoing Series B financing, at a $900 million pre-money valuation.

- Stellarator: Type One’s chosen magnetic-confinement design for containing fusion plasma.

- Infinity Two: the name given to the planned 350 MW power plant Type One has agreed to site with the Tennessee Valley Authority at the former Bull Run coal plant.

- Mid-2030s: the company’s stated target window for Infinity Two to potentially come online.

- Business model: Type One plans to sell key reactor technology to utilities and plant operators rather than build and operate plants itself.

- Prior funding: a 2023 seed round reported at $29 million was extended to $82.5 million in 2024; investors included Breakthrough Energy Ventures (funded by Bill Gates), Doral Energy Tech Ventures, and TDK Ventures.

- Demand context: data centers are expected to use nearly three times more electricity by 2035; overall electricity demand was forecast to grow about 4% annually through next year.

What to watch next

- Whether Type One closes its $250 million Series B and the final valuation achieved.

- Progress on technical milestones for the stellarator design leading toward a commercial prototype or site-ready system.

- not confirmed in the source: regulatory approvals, construction permits, and grid-connection timelines for Infinity Two.

- not confirmed in the source: the detailed commercial terms between Type One and the Tennessee Valley Authority or other potential utility partners.

Quick glossary

- Stellarator: A type of magnetic-confinement fusion device that uses a twisted, non-axisymmetric arrangement of magnets to confine hot plasma.

- Magnetic confinement fusion: An approach to fusion that uses strong magnetic fields to contain and control plasma so that atomic nuclei can fuse and release energy.

- Convertible note: A short-term debt instrument that converts into equity under specified conditions, often used in startup financing rounds.

- Pre-money valuation: The valuation of a company prior to receiving new investment capital; used to determine investor equity percentages in a funding round.

- Plasma: A high-energy state of matter composed of charged particles (ions and electrons) in which fusion reactions can occur under certain conditions.

Reader FAQ

How much did Type One raise in this round?

The company raised an $87 million convertible note.

How much has Type One raised overall?

Type One’s venture funding totals more than $160 million after the new note.

Who are some of the company’s investors?

Past investors named in earlier rounds include Breakthrough Energy Ventures, Doral Energy Tech Ventures, and TDK Ventures.

When will Type One’s first plant start producing power?

The company has said Infinity Two could come online in the mid-2030s.

Will Type One build and operate the plants itself?

No — the company plans to sell key technology to utilities and power providers who will build, own, and operate the plants.

Fusion power startup Type One Energy recently raised $87 million, TechCrunch has learned from sources familiar with the deal. The new funding is a convertible note that brings the total…

Sources

- Bill Gates-backed Type One Energy raises $87M ahead of $250M Series B

- Bill Gates-backed Type One Energy raises $87M ahead …

- Bandcamp takes a stand against AI music, banning it from …

- Search

Related posts

- Black soldier fly larvae: efficient protein source eyed as future superfood

- Parents Can Now Set Time Limits for Kids on YouTube Shorts Feed

- Sid Meier’s Civilization VII Comes to Apple Arcade on February 5