TL;DR

A Duke professor lays out the university’s financial model: substantial net assets ($22.6B at FY2024) are split between the academic unit and a large health system, and yearly investment returns drive much of what the university can afford. Research grants, clinical operations and endowment performance are central revenue sources, while salaries consume most expenses.

What happened

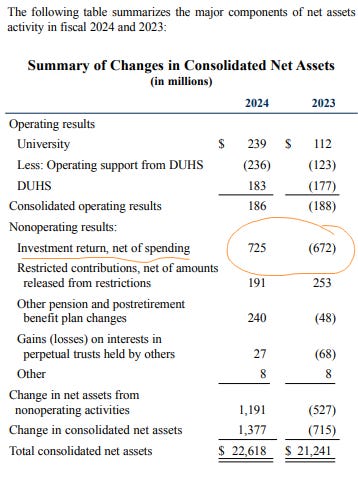

Professor Don Taylor examined Duke University’s finances to show how incentives and cash flows shape priorities on campus. At the end of fiscal 2024 Duke reported $22.6 billion in net assets, with about $16.6 billion attributed to the University and $6.0 billion to the Duke University Health System (DUHS), a wholly controlled affiliate that owns hospitals, physician practices and a malpractice insurer. Operating revenue for July 2023–June 2024 was about $3.9 billion, with research grants and contracts accounting for roughly 40% of university dollars. Investment returns are especially consequential: a swing from a $672 million shortfall relative to investments in 2023 to a $725 million surplus in 2024 changed available funds by nearly $1.4 billion, in part influenced by DUHS’s acquisition of a long-standing physician practice. Compensation makes up about 63% of operating expenses, and athletics sits inside an 8% auxiliary category.

Why it matters

- Year-to-year investment performance can materially expand or constrain what Duke can fund.

- The health system’s results and transactions directly affect the university’s bottom line.

- Research funding and federal grants are a core revenue stream that supports Duke’s mission.

- High personnel costs limit managerial flexibility when budget reductions are considered.

Key facts

- Net assets at end of FY2024: $22.6 billion (University $16.6B; DUHS $6.0B).

- Operating revenue for July 2023–June 2024: approximately $3.9 billion.

- Research grants and contracts represent about 4 in 10 university dollars; federal grants ~ $1 billion; private foundations ~$410 million.

- School of Medicine research funding in that year exceeded $1.1 billion.

- Investment returns supplied a larger share of revenue (21%) than tuition (net of financial aid) at 15%.

- Duke University Medical Center’s investment company (DUMAC) drives returns that meaningfully affect available spending.

- Duke spent $672 million more than investment returns in 2023, then earned $725 million more than spending in 2024 — a near $1.4 billion swing.

- Salaries and benefits account for about 63% of operating expenses.

- Athletics are included in an 8% auxiliary category; a 2022–23 report cited roughly $150.5 million in athletic expenses and $152.5 million in revenue.

What to watch next

- Year-to-year performance of Duke’s investment portfolio (DUMAC) and its effect on discretionary spending.

- Financial results and strategic moves by the Duke University Health System and their spillover to university finances.

- Plans to address the university’s deferred maintenance backlog — not confirmed in the source.

Quick glossary

- Net assets: The difference between total assets and liabilities; a broad snapshot of institutional wealth reported on a balance sheet.

- Endowment / investment returns: Funds invested to generate returns that can be spent to support operations, scholarships, research and other activities.

- Operating revenue: Money earned during normal activities, such as tuition, research grants, clinical income and investment distributions.

- Research grants and contracts: Funds awarded (often by government agencies or foundations) to support sponsored research projects and related costs.

- Auxiliary enterprises: Revenue-generating campus services—like athletics, housing, dining and parking—typically accounted for separately from academic budgets.

Reader FAQ

Is Duke a wealthy university?

Duke reported $22.6 billion in net assets at the end of FY2024, but available funds are constrained by commitments and competing priorities; the author summarizes the answer as 'yes, and no.'

How important are investment returns to Duke’s budget?

Very important—investment performance produced swings measured in hundreds of millions of dollars between 2023 and 2024 and supplies a larger share of revenue than tuition.

How much of Duke’s revenue comes from research?

Research grants and contracts account for roughly 40% of university dollars; the federal government provided about $1 billion and private foundations about $410 million in the cited year.

Does the health system belong to the university?

Yes; DUHS is described as a wholly controlled affiliate of Duke University that owns hospitals and physician practices.

Will Duke increase spending on deferred maintenance or wages?

Not confirmed in the source.

Discover more from Professor Taylor's Two Ditches Substack Duke Professor in his 29th year writing about higher education reform, academic freedom and the hidden incentives in the academy Subscribe By…

Sources

Related posts

- Who Invented the Transistor? Examining a Persistent Historical Question

- Treat the Compiler as Your Friend: Stop Lying to It, Prevent Crashes

- Inside Nvidia GB10’s CPU-Side Memory Subsystem and Design Tradeoffs