TL;DR

Startups developing small modular reactors have attracted heavy investment recently, driven by a hope that mass production will cut costs compared with giant traditional plants. Industry observers warn that supply-chain gaps, lost domestic manufacturing know‑how and the long time horizon for learning through production could blunt those gains.

What happened

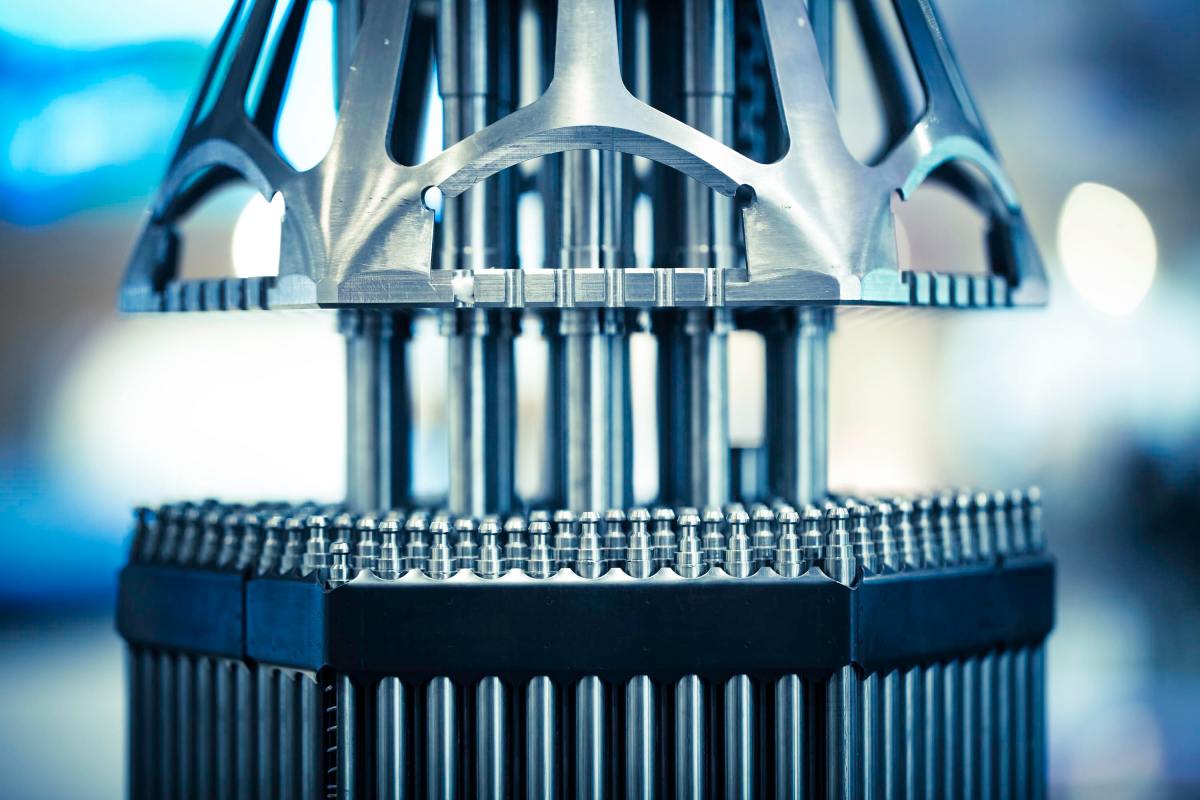

The nuclear sector is experiencing renewed activity: aging plants are being refurbished while a wave of startups focused on small modular reactors (SMRs) has drawn substantial funding. In the span of several weeks in 2025 these companies raised about $1.1 billion, betting that smaller units built with repeatable, factory-style processes can be scaled up to deliver lower costs and greater flexibility than the newest large reactors. The article contrasts that pitch with recent U.S. experience: the latest big reactors, Vogtle units 3 and 4, required vast amounts of concrete, used large fuel assemblies and deliver over 1 GW each — but were years behind schedule and billions over budget. Investors and founders flag two main manufacturing obstacles: while capital seems available, the United States lacks breadth of recent experience in building heavy industrial facilities and makes fewer nuclear-grade materials domestically. Experts note that achieving meaningful cost reductions through learning in production can take many years, perhaps a decade.

Why it matters

- If SMRs can be produced at scale, they could offer more flexible and modular additions to electricity systems compared with very large plants.

- Overreliance on optimistic manufacturing learning curves risks underestimating timeline and cost exposure for new reactor programs.

- Gaps in domestic supply chains and manufacturing experience could create dependencies on foreign suppliers or slow deployment.

- Workforce and factory-construction shortfalls could become bottlenecks even when investor capital is available.

Key facts

- Nuclear startups raised about $1.1 billion in the last several weeks of 2025, according to the source.

- Vogtle units 3 and 4 in Georgia are cited as examples of modern large reactors: they involve tens of thousands of tons of concrete, use fuel assemblies roughly 14 feet tall, and each produces more than 1 gigawatt.

- Those Vogtle units were finished about eight years late and reportedly more than $20 billion over budget.

- Startups argue that SMRs can be mass-manufactured and deployed in multiples to meet higher power needs.

- Experts say the magnitude of cost reductions from mass production for nuclear components is still under study and not guaranteed.

- Investor capital for nuclear startups is currently plentiful, but human capital for heavy industrial manufacturing in the U.S. is limited.

- Some materials needed for nuclear manufacturing are no longer produced domestically; industry participants estimate several such items must be sourced abroad.

- Industry observers caution that meaningful manufacturing learning and cost declines often require many years, potentially on the order of a decade.

What to watch next

- Progress by startups in building domestic factory capacity and hiring experienced manufacturing staff.

- Development of U.S. supply chains for nuclear-grade materials and components.

- Independent analyses or pilot programs that quantify potential cost reductions from mass production of SMRs.

Quick glossary

- Small modular reactor (SMR): A nuclear fission reactor designed to be smaller in power output and often constructed from prefabricated modules to enable factory production and incremental deployment.

- Mass manufacturing: An approach to producing large volumes of standardized components or products in factories to reduce per-unit costs through repetition and process improvements.

- Supply chain: The network of suppliers, manufacturers, logistics and services required to produce and deliver a product.

- Modularity: Designing systems as separable units that can be independently produced, replaced or combined to create larger assemblies.

- Learning curve (manufacturing): The improvement in efficiency and cost as a production process is repeated over time, often requiring years to materialize.

Reader FAQ

Have nuclear startups recently raised significant funding?

Yes. The source reports roughly $1.1 billion raised by startups in the last several weeks of 2025.

Will smaller reactors definitely be cheaper than large plants?

Not confirmed in the source. Startups are betting on cost reductions from mass manufacturing, but experts say the size of those gains is still being studied and not assured.

Does the U.S. have the manufacturing base to produce SMRs at scale?

The source indicates the U.S. currently lacks broad recent experience building heavy industrial facilities and that several nuclear-grade materials are not now produced domestically.

How long might it take to realize cost reductions from manufacturing learning?

Industry observers cited in the source say it can take many years and sometimes around a decade to achieve the anticipated gains from learning in production.

The nuclear industry is in the mist of a renaissance. Old plants are being refurbished, and investors are showering startups with cash. In the last several weeks of 2025 alone,…

Sources

- Nuclear startups are back in vogue with small reactors, and big challenges

- Oklo Faces High Expectations Amid Nuclear Power Push …

- Advanced Nuclear Developers Raise New Capital as 2025 …

- Top investment themes to watch in 2026 – IG

Related posts

- Wing to expand drone deliveries to 150 additional Walmart stores in 2026

- Razer’s Project AVA draws online scorn after CES 2026 hologram reveal

- Selling WhatsApp to Facebook Would Be Jan Koum and Brian Acton’s Biggest Mistake