TL;DR

Tally is presented as a tool to help agents interpret and classify bank transaction lines that are often cryptic. The project highlights how generic bank categories and messy merchant descriptors hinder detailed tracking, using real transaction examples to illustrate the problem.

What happened

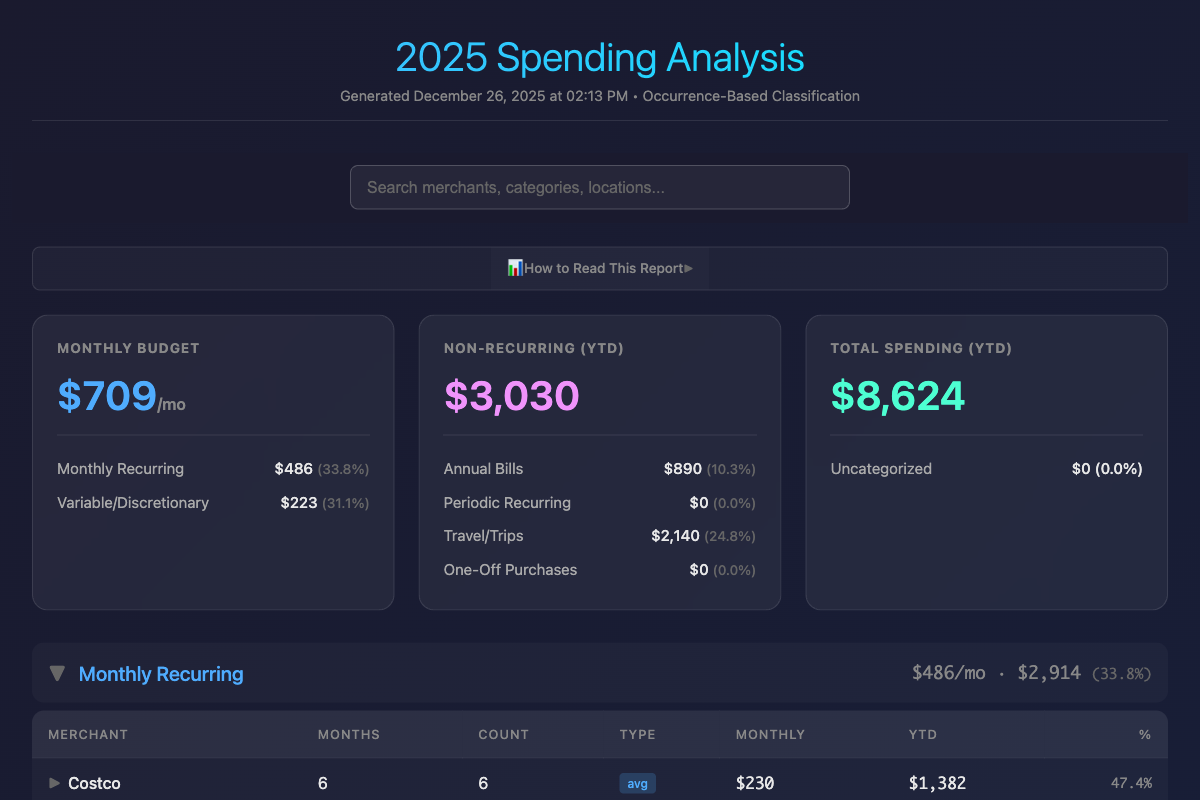

A project called Tally positions itself as a solution for classifying everyday bank transaction records that are difficult to read and categorize. The source frames the issue with concrete examples — merchant lines such as "WHOLEFDS MKT 10847 SEATTLE WA," "AMZN MKTP US*2K7X9," and "SQ *JOES COFFEE SEATTLE" — and says banks’ default categories are often too coarse. According to the presentation, a single "Shopping" label can hide distinctions users want, such as "Kids > Clothing" versus "Home > Furniture," and restaurant spending can be lumped together even when people want "Coffee" tracked separately from "Fast Food." The material on the Tally site focuses on this classification gap and proposes agent-based categorization as a way to make transaction data more granular and useful.

Why it matters

- Cryptic merchant descriptors make personal finance records harder to interpret and reconcile.

- Overly broad bank categories can obscure spending patterns users want to track.

- More granular classification can improve budgeting, expense analysis and bookkeeping accuracy.

- Clearer labels can reduce time spent manually re-categorizing transactions.

Key facts

- Project name shown as Tally, described as a tool to help agents classify bank transactions.

- Source emphasizes that many bank transaction descriptions are hard to read and understand.

- Examples cited include: WHOLEFDS MKT 10847 SEATTLE WA; AMZN MKTP US*2K7X9; SQ *JOES COFFEE SEATTLE.

- The source highlights that bank categories are frequently too broad, e.g., a single "Shopping" label.

- The site argues users may want subcategories like "Kids > Clothing" or distinctions such as "Coffee" vs "Fast Food."

- Content appears on tallyai.money and was published on 2026-01-03 according to the source metadata.

- The presented material is framed under a "THE PROBLEM" heading that focuses on transaction readability and categorization.

What to watch next

- Whether Tally will provide integrations with banks or financial data providers: not confirmed in the source.

- If Tally relies on machine learning or other agent technologies to classify transactions: not confirmed in the source.

- How the project will handle user privacy and permissions when accessing transaction data: not confirmed in the source.

Quick glossary

- Merchant descriptor: The text a bank or payment network shows on a transaction that identifies the merchant and location, often abbreviated or formatted inconsistently.

- Transaction categorization: The assignment of a spending label (e.g., groceries, dining) to a financial transaction to help track and analyze expenses.

- Subcategory: A more specific classification nested under a broader category, used to capture finer distinctions in spending.

- Agent (in software contexts): A component or program that performs tasks such as classification or data processing on behalf of a user or system.

Reader FAQ

What is Tally?

According to the source, Tally is a tool intended to help agents classify bank transactions that are often cryptic or poorly categorized.

Does Tally use AI or machine learning?

not confirmed in the source

Will Tally integrate with my bank or financial app?

not confirmed in the source

How does Tally improve on bank-provided categories?

The source says it addresses overly broad categories by enabling finer-grained classification, such as distinguishing specific subcategories and types of restaurant spending.

THE PROBLEM WHOLEFDS MKT 10847 SEATTLE WA AMZN MKTP US*2K7X9 SQ *JOES COFFEE SEATTLE Bank transactions look like gibberish. Your bank's categories are too broad—"Shopping" when you need "Kids >…

Sources

- Tally – A tool to help agents classify your bank transactions

- davidfowl/tally: Let agents classify your bank transactions.

- Tired of Manual CSV Transaction Categorization? – Tallify.ai

- Bank Reconciliation with TallyPrime: Simplify Your Finances

Related posts

- Rust veteran builds Rue programming language with Claude as copilot

- Survey: How Macs’ longevity and automation boost enterprise sustainability

- I Ran an AI Misinformation Experiment — Most Models Repeated Fake Brand Claims